There are essentially two types of Centrelink loans available and multiple options within these two…

Are There Loan Options for the Unemployed? 100%

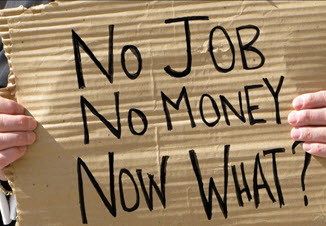

Unemployment often comes with a series of financial hardships, and not all of them can be met through traditional assistance programs. But finding a loan when you’re unemployed isn’t the easiest feat.

Unemployment often comes with a series of financial hardships, and not all of them can be met through traditional assistance programs. But finding a loan when you’re unemployed isn’t the easiest feat.

However, it isn’t impossible either. In fact, some lenders provide options specifically to those dealing with unemployment.

To help you understand loan options for the unemployed, here are some key points to consider before deciding to go forward with a loan.

Source of Income

A simple fact is you can’t get a loan without a source of income. However, in the case of loans for the unemployed, that source of income can be Centrelink payments. Just as with other income methods, you will need to demonstrate the amount you receive as well as an overview of your other expenses. This information will be used to estimate what you can reasonably afford to manage as a debt, leading to the next topic.

Repayment Capabilities

One question every lender considers before providing a loan is whether they believe you can reasonably repay the borrowed funds. And, for those receiving assistance due to unemployment, that can be a concern. This means lenders are automatically more hesitant to provide you with funds regardless of other factors, such as credit history.

Generally, the higher the amount being requested is, the less likely you are to be approved. Additionally, traditional lenders are less likely to consider loans to unemployed individuals, meaning you may be stuck looking into payday loans or other subprime options.

Interest Rates

Most loans designed for unemployed individuals come with higher interest rates than traditional loans. This is a direct reflection of the increased risk associated with making the loan. However, these higher rates can make the loan cost prohibitive for those stretching to make ends meet.

Now, you may see more favorable interest rates if you have a higher credit rating, but they will generally not compare with the rates an employed individual with a similar credit score can find from a regular lender.

Available Assets

In some cases, you can increase your chances of being approved if you can support the loan with an available asset. This is referred to as a secured loan, as the asset serves as collateral. Some of the most common items used as collateral are vehicles, such as cars and boats, as well as real estate. However, some lenders may accept other items like fine jewelry or art. Regardless of the type of asset, it is important that the borrower own it outright as they have to have the ability to pledge its value to the lender to support the loan application.

What if I Don’t Qualify?

If you don’t qualify for an unemployed loan, then other options may be available. For example, you may be able to get a friend or family member to cosign on the loan, or they may even be able to lend you the funds themselves. In other cases, you may qualify for emergency assistance from the government or local charities. This means it is important to explore all of your options to determine which approach is best for you and your needs.

For a list of different LOAN OPTIONS, visit our unemployed loans section.

Comments (0)