There are essentially two types of Centrelink loans available and multiple options within these two…

Financial Help Queensland – Help paying bills, rent, loans & more

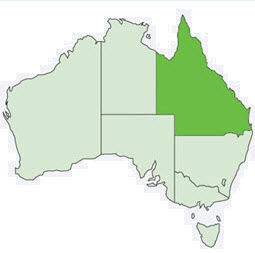

Are you dealing with money difficulties and need help? Learn about the different National and QLD financial support programs including; loans, bill assistance, advice, counselling and more.

Are you dealing with money difficulties and need help? Learn about the different National and QLD financial support programs including; loans, bill assistance, advice, counselling and more.

There are numerous free financial facilities for Australians throughout QLD. Whether you live in one of the larger regions such as Brisbane, Gold Coast, Sunshine Coast or Townsville; or smaller regional areas such as Cairns, Toowoomba or Bundaberg there are services available to you. Even small country towns have access to local and national financial assistance and programs. Many Queenslanders just don’t know what is available and where to go.

The Queensland government and multiple non-profits have created many different rebates, concessions, and discounts that are designed to help eligible residence within the state cover some of their household expenses. This can help make things more affordable and help you handle your bills with less pressure.

Below is a look at the top financial assistance programs for low-income earners in Queensland.

If you are in need of immediate financial assistance, visit our loans options section.

Household Costs

Home Energy Emergency Assistance Scheme. This program provides eligible residents with a rebate to help cover some of their energy costs throughout the year. If you qualify, you could receive a rebate of up to $720 per year.

Electricity Life Support. If you are on a specialised life support system, the government may help you pay for some of the costs involved in operating that system on a regular basis. The amount of support you will receive to help with your electric bill will vary based on the type of machine you are using. For example, if you have a kidney dialysis machine, you could receive up to $ 36.48 per month, however, if you are on an oxygen concentrator you could receive up to $54.48.

Medical Cooling and Heating Electricity Concession Scheme. If you have a medical condition that requires you to keep your home at a set temperature throughout the year, the government will help cover a portion of your heating and cooling expenses. You could receive up to $320.97 per year.

Water Subsidy. If you are a pensioner or a Gold Card veteran, you could receive a special subsidy to help cover the cost of your annual water bill. This is a subsidy of up to $120 per year.

First Home Buyer Grant. If you are purchasing a home for the first time, you may be eligible for this special grant. You may receive a grant of up to $15,000 to use towards the down payment to purchase or build a new home.

Bond Loans. If you rent your home, but need help covering the bond required to set up a new apartment, you may qualify for a bond loan. This is a non-interest bond and will need to be repaid in small increments over time.

Rental Grant. This grant can help low-income earners and seniors who are rent pay for up to two-weeks of their current rent, or two-week are rent arrears.

Health Care

Spectacle Supply Scheme (SSS). If eligible, you can receive help purchasing a new pair of eyeglasses or contacts one time every two years.

Transport Fees

Transport Fares Concession. This concession is for qualified children, students, low-income earners, pensioners, seniors, and veterans. It provides a 50 per cent discount of the cost of public transportation.

Registration Concession. This concession is just for pensioners, seniors, and veterans and reduced the amount you need to pay for your motor vehicle registration.

Seniors

Senior Card. To qualify for the Queensland Senior Card, you must be over the age of 60-years old and work less than 35 hours per week. If eligible, you can receive a special discount at participating retail stores, transport services, dining establishments, governmental agencies, accommodations, health care services, prescriptions, and more.

Miscellaneous Expenses

Council Rate Concession. Pensioners who qualify can receive up to a 20 per cent discount off their council rate up to a maximum of $200.

Non-Profits

FNQ Youth Assistance Fund. Assists disadvantaged youth in Far North Queensland in education, sports and cultural activities who would otherwise miss out due to difficult financial situations.

A Fairer Queensland – Assists people in finding affordable housing. They also advocate for and advise disabled and homeless individuals. They also provide mental health information and help children. Their goal is to leave no one behind.

Adventist Development and Relief Agency. Assists people who are living in poverty or those who need disaster assistance. They offer emergency food assistance and referrals for other services as well. They are popularly referred to as ADRA.

No Interest Loan Scheme (QLD). No interest loans available to help local residents get a loan for home essentials such as appliances or medical equipment that is repayable within 12 to 18 months. This loan scheme is available to low income earners who find them themselves in need of short term financial assistance but prefer to not receive charity.

Depending on your location there may also be other non-profits that will assist you such as; The Salvos, Vinnies, Anglicare and others.

Financial Advice

Financial Counselling Australia. If you are having financial issues and need professional advice, talking to a professional financial counsellor would be highly recommended. The Financial Counsellors of Australia are free and will be able to provide you with information on services within your immediate area.

Hi there, I’m after the step up loan and also wondering if I can get a call back on 0434860128. Thanks.

Hi Lasela,

Here are the numbers to StepUp offices in Queensland – Arundel Ph: 07 5514 5306, Parramatta Park Ph: 07 4080 7400, Runcorn Ph: 07 3373 9499, Springwood Ph: 07 3808 4529

, Sumner Park Ph: 07 3716 1206.

Regards,

LILA

Hi, I’m in a bit of trouble with my power bill, I’ve never asked for assistance before and have no idea where to start, could you point me in the right direction please?

I have a $546 bill, overdue and must pay $140 immediately or disconnected on Monday.

Thank you

Hi Darren,

Please review the following pages for assistance – help with bills and financial hardship assistance

Hello,

I’m a single mother of 1, and on single parent benefits from Centrelink. I am after $3000 loan. I was looking into step up, but just wondering about interest rates and where can I go for more information/apply?

Hi Bree,

You can read more about StepUp loans here and you can apply at the Good Shepard Micro Finance website.

Hi would I be able to get a loan to fix my car as I can’t get around I’m 62 and on Centrelink Newstart

Hi,

I have few enquiries, I was working full until I had a car crash last year where I found out I was pregnant. I got on the Centrelink and got approved for Newstart but now that I had my child I put through my parental payment and family tax.

What my question really is, I have a small car I would like to trade for a family car, am I able to do that whilst on newstart? (I am currently receiving $590) and waiting for my My FTP to clear this week.

Thank you

Amie

Hi im bill was wondering where i can aply for a step up loan as i need to buy a car to keep haveing access whith my two children im on a pension can you help please

Hi how woulf i go for a car loan on a aged pension i get 808 dollars a fortnight and sraying with family i only pay 400 a fortnight for rent and food combined with no other bills to pay i also get 400 per month super payment please advise if i am elligble for a 6000 loan over 4 years many thanks noel

Hi there I’m just writing to you to find out if at all possible if I could get a lone of $2593.71 to pay for my phone bill and my car registration for as I’m only on a Centrelink payment each Fortnight for as I’m having trouble finding the money to for them so could someone please help me out with this matter please thank you.

Hi,

I currently need some help with rental arrears. I have a notice to remedy breach which is due before I receive my next Centrelink payment. Our property managers are unreasonable and have threatened with a notice to leave if not fixed by due date. What assistance can help us?

Thanks

Luke

I am $1700 dollars in rent arrears and only get New start Allowance of 660/fortnight.

I have tried negotiating with the landlord but all he says is that he will start court proceedings next Monday.I have never been in this sort of trouble before. Is there any place that can help.

You can get a grant for two weeks rent for housing and apply for a payment plan for your arrears, try getting out before you get blacklisted, share if you have to, but make sure you pay all arrears

Hi, im in need of financial assistance. I am on carer payment and allowance, and receive family tax benefits until end of December 2016. The past 3 years have been a nightmare. Both my daughter and myself have medical problems. We have gone through a rodents infestation. Where we lost majority of our household things. I have fallen behind in rent and other bills. I really need a car, to get my daughter and i to our appointments. Please , please, please and i would love to study or work. I have lost my personal paperwork to help with work. I live in qld housing and pay almost $200 week. I have been told too about court. Please if someone could help it would be great. Thank you

Hi there im in need of help with rent, i lost my job in october this year had an operation in November and waiting for another op to be done. Im going through depression and anxiety and alot of stress. Ive been trying to contact real estate to try and solve it but no one would contact me back. I cant afford to move anywhere else for haven’t got the money and have no close relations near by. If by any chance someone can help me be much appreciated if not we will be homeless by the beginning of next week. Thanks

Hi

I wanting to know if there are any pensioner loans to get a house. I am a carer for my daughter with autism and would liek to start paying off a home as change is very difficult for her. Any ideas who I could approach.

Pene