There are essentially two types of Centrelink loans available and multiple options within these two…

Getting the Best Low Income Credit Card

While credit cards can be a very bad financial decision, they are a necessary financial product needed for many things these days – car rental, hotel room reservation, booking travel, emergencies and more.

While credit cards can be a very bad financial decision, they are a necessary financial product needed for many things these days – car rental, hotel room reservation, booking travel, emergencies and more.

Using credit cards properly requires discipline and an absolute determination that you will only use the credit cards to the extent that you can pay them off entirely every single month. If you are unable to pay them off every month, you could end up with thousands in interest rate repayments and fees.

If you do decide that a credit card would fit your lifestyle and you know you can manage payments responsibly, here are a few tips to help you choose the best card for your family:

Check out the benefits

One of the only reasons you have a credit card is to take advantage of benefits the card offers. Many cards offer air miles, cash backs, points and other rewards. Research different cards to determine which benefits would work best for your family.

Make sure to read the fine print to ensure that you can reasonably expect to earn benefits without putting yourself in a financially precarious situation.

Annual fees

Many people argue against cards that have any annual fees. However, you miss some major benefits. If you can afford to pay the annual fee off in one lump payment, this type of card could offer better benefits for your family.

Keep in mind that while free has benefits; annual fee cards often offer better up-front benefits and ongoing rewards. If you can reasonably meet goals to qualify for rewards, this may be a good option for you.

Interest rate/APR

Your interest rate and APR are major factors in determining how much you will actually pay. If you pay your bills on time (and pay off your card every month) these numbers may not be as important. However, if you miss a payment or are unable to pay off your bill one month, this will affect the total you owe.

Take advantage of Rewards

To maximise rewards on your card, you have to charge more expenses. One option that works for some people is to pay all of their monthly bills on their credit card. When the card comes due, they use the money they would have used to pay their bills traditionally to pay off the balance on their credit cards. This great method will allow you to rack up major bonuses quickly, if you pay off the card every month. If you cannot pay it off, this could backfire quickly.

Another method is to choose one bill or expense and use the card to pay for that one expense each month. Groceries and gas are two common options. This is a safer option than paying off all expenses, as a missed payment one month will not be nearly as costly. Do note that many feel that rewards programs are gimmick and aren’t worth it.

Emergency Fund

If you plan to use credit cards to earn points for cash or vacation points, make sure you have an emergency fund set up. This will help ensure that you can keep your payments if there is an emergency and negates the need to use your card for unexpected expenses.

Credit cards can be a useful tool, but only if used responsibly.

Low Income and Centrelink Credit Card Options

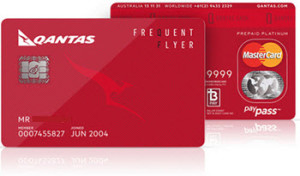

If you are a low income earner in need of a credit card, there are other options to the normal bank credit cards. These options can be used by those on Centrelink or with bad credit. The only catch is that they are a line of credit of your own money. They do however allow you access to all the same features of purchase as a bank credit card. In addition, on the positive side of things, they can keep you from going into debt as these cards are preloaded with your own savings.

If you need of a credit card for its ability to book items or serve as an emergency fund, look at prepaid credit cards and debit credit cards, which are attached to your bank account(s). These are excellent options for anyone wanting a credit card that doesn’t come with high interest rates, annual charges and fees.

Comments (0)