There are essentially two types of Centrelink loans available and multiple options within these two…

How to qualify for a personal loan

Many people apply who apply for loans think it’s just a matter of fulfilling the general eligibility criteria that different lenders provide.

Many people apply who apply for loans think it’s just a matter of fulfilling the general eligibility criteria that different lenders provide.

This can be a bit misleading as this is the minimal requirement that they have to just be considered. Many borrowers mistake the work “eligible” for approval criteria, it’s a simple oversight. Having a better understanding on what lenders look for will make it easier to get approved and safe yourself the disappointment of being knocked back.

Many lenders will provide some form of the below:

– 18 years or older

– Australian citizen or resident

– Employed (earning an minimum amount like $25,000)

– Borrow up to $5000

It’s easy to see how a person might look at that and see a “apply” button beneath that and think this is easy. It’s the actual application where the real qualification for the loan takes place. Essentially they will look at some variation of the following and possibly more – depending on the lender.

– Credit history

– Debt

– Length of employment

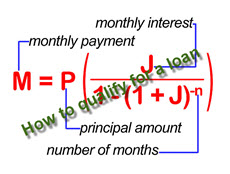

– Loan serviceability (compare your total monthly expenses against your income to see if you can afford to make your repayments)

– Purpose of loan

– Length of time at your residency

– If you have savings

– And possibly more

As you can see there is a lot more to the small eligibility points that most lenders provide. Whilst there are many actual qualification criteria, this gives you the ability to work on different areas to help strengthen your position to get approved.

Below is a list of tips to help you improve your chances of getting approved for a personal loan.

– Provide a history of savings

– Be able to provide a history of making repayments; like utilities or mobile bills

– Reduce your unsecure debt as much as possible

– Have a decent employment history. Even if you have moved around in roles, showing that you’re always working helps

– Don’t apply for too much; possibly use a borrowing calculator first to give you an idea of what you can afford based on your expenses versus income – Personal loan calculator by moneysmart.gov.au

If all else fails or you still have questions, contact the lender over the phone and talk through the loan and borrowing process with them. Make sure you are aware of all fees and the costs associated with borrowing with them.

If you feel that you won’t qualify for a mainstream loan based on the above and you are facing a financial emergency, there are other options. In Australia there are certain specialty loans for low income earners and those on Centrelink. Learn about other loan services here.

This Post Has 0 Comments